New Sales Tax Rate in Pakistan 2025

The government wants to increase tax collection by using indirect taxes (like sales tax) instead of direct taxes (like income tax). The goal is to raise Rs 7,229 billion in taxes this year.But these changes could also make things more expensive and increase inflation, affecting ordinary people’s budgets

File Your Sales Tax with Waystax.com

Don’t let changing tax rates slow down your business. With us , you get simple, accurate, and hassle-free sales tax filing in Pakistan.

Key Changes in Sales Tax Rate in Pakistan ( Budget 2025-2026)

- Small Cars Now More Expensive

All small cars up to 850cc (petrol, diesel, and hybrid) will now have 18% sales tax. Before, these cars had lower tax or were tax-free. This means small cars will now cost more. - Tax on Solar Panels

Imported solar panels and equipment used for solar energy will now also have 18% sales tax. These were tax-free before, so solar setups will now become more expensive. - Tax on Online Shopping

Online shopping (e-commerce) will now be taxed. A 2% sales tax will be added to online orders. Companies like courier services, banks, and payment apps must collect this tax and give it to the government. - More Items Added to Tax List

Items like imported coffee, chocolates, energy bars, and pet food will now have tax added at the retail (shop) level. These are now part of the list that collects full tax at the sale point. - Transport Services Taxed

Freight services (used to transport goods, even food) will now also have an 18% sales tax. This can increase the cost of goods being transported across the country. - More Control on Online Deliveries

The government is adding more rules to track online deliveries and e-commerce cargo, and will collect taxes through banks and courier services. - SEZ/STZ Tax Benefits Limited

Businesses in Special Economic Zones (SEZs) and Special Technology Zones (STZs) will now get sales tax exemption only for up to 10 years or until 2035, whichever comes first. - Tax on FATA/PATA Solar and Industry Removed

Industries and solar projects in FATA/PATA areas will no longer have special sales tax exemptions. This may cause problems for local businesses there. - New Tax on Foreign Online Shopping and Ads

A new law called the Digital Presence Proceeds Tax Act, 2025 has been introduced to tax foreign companies that sell to Pakistani customers online. Now, a 5% tax will apply to goods bought from international websites like AliExpress, Temu, and Amazon. - Foreign Digital Ads

In addition, foreign companies that run digital ads in Pakistan will also pay a 5% tax on their advertising spend. These companies, along with payment platforms and social media sites, must submit quarterly tax reports to the government. If they fail to do so, they will face a fine of Rs. 1 million per quarter.

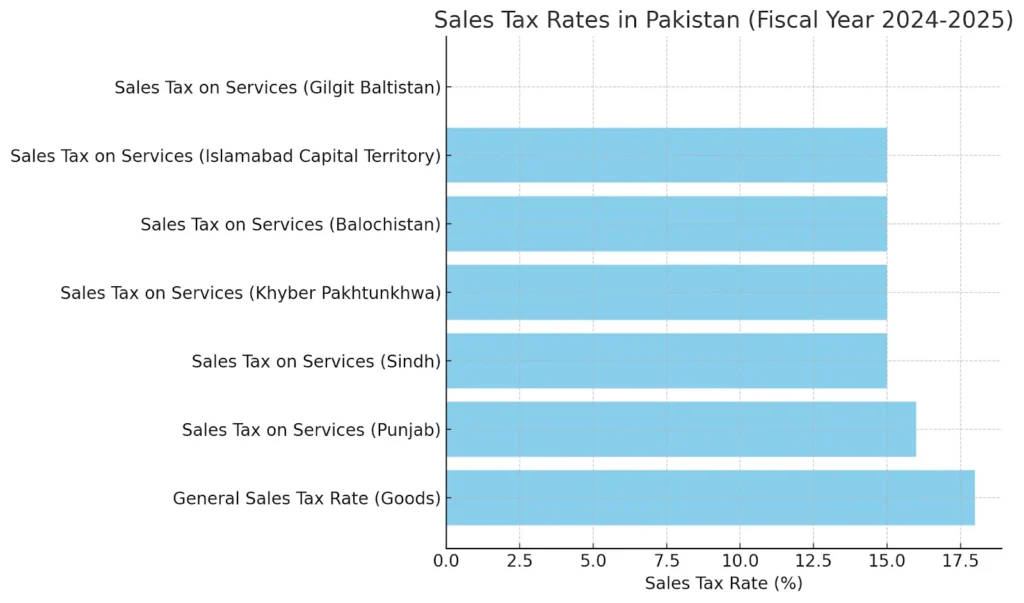

Current Sales Tax Rates in Pakistan on Services by Region

- Punjab Revenue Authority sales tax rate: The Punjab Revenue Authority (PRA) charges a standard sales tax rate of 16% on services, with telecommunication services taxed at 19.5%.

- Sindh sales tax on services rates: The Sindh Revenue Board (SRB) imposes a sales tax on services generally at 15% (increased from 13% in previous years), with specific rates for sectors such as telecommunication services at 19.5%, restaurants, marriage halls, professionals, insurance, and advertisements mostly at 15%, and some reduced rates for hospitals and clinics (3%).

- The sales tax on services in Islamabad is 15- 16%. For IT and IT-enabled services, the Federal Board of Revenue (FBR) clarified that they have been subject to sales tax at 16% since 2015 but were reduced to 5% in 2018. The definition of IT services for sales tax purposes aligns with the Income Tax Ordinance, of 2001.

- KPK sales tax on services rates: The sales tax rate on services is 15%.

- Balochistan: The sales tax rate on services is 15%.

- Gilgit Baltistan: No sales tax on services (0%).

Additional Notes

- There is an additional 4% sales tax charged on supplies to unregistered persons or entities, with possible exemptions by the Federal Government.

- Some goods and services have special or increased rates, for example, certain imported goods and vehicles are taxed at 25% since March 2023.

- Punjab does not currently have an exemption threshold for services taxable under its Sales Tax on Services Act, 2012, though exemptions for certain hotel services are under consideration.

- Sindh offers conditional exemptions and tiered tax rates for specific sectors like beauty parlors and clinics, with rates ranging from 5% to 15% depending on compliance and turnover.

Region Wise Sales Tax Rate on Services in Pakistan

| Region | Sales Tax Rate on Services | Special Notes |

| Pakistan (General) | 18% (goods) | General goods tax rate |

| Punjab | 16% | Telecom services at 19.5% |

| Sindh | 13% | Telecom at 19.5%, various sector rates |

| Islamabad (ICT) | 15% | IT services reduced to 5% |

| Khyber Pakhtunkhwa | 15% | |

| Balochistan | 15% | |

| Gilgit Baltistan | 0% | No sales tax on services |

This reflects the latest tax structure as of 2024-2025, with the general sales tax rate stabilized at 18% and provincial variations for services tax rates

Sales Tax Rate in Pakistan Chart

Reduced Rates of Sales Tax in Pakistan

The reduced rates of sales tax in Pakistan vary by sector, province, and specific services or goods, often designed to encourage compliance or support certain industries. Key reduced sales tax rates include:

- Sindh Province:

- Rural cable TV operators: 10%

- Standalone cable TV operators: 2%

- Restaurant services with digital payments: 8%

- Standalone recruiting agents for overseas employment: 5% (extended until mid-2026)

- Some services like education and medical practitioners are taxable at reduced rates beyond exemption thresholds, with specific thresholds applied.

- Federal Level and Other Provinces:

- Small companies benefit from a reduced income tax rate of 20%, but sales tax on goods remains at the standard 18% unless otherwise specified.

- Personal computers and laptop imports are taxed at 10%, reduced from the previous rates.

- Pharmaceuticals (medicaments) were reintroduced at 18% from a previous 1%, indicating some sectors have lost reduced rates recently.

- LPG sales tax increased from 10% to 18%, showing some reduced rates have been withdrawn

List of Goods Exempted from Sales Tax in Pakistan for Zone Port Businesses

| Category | Description/Notes |

| Pharmaceuticals and medical supplies | Exempt to keep healthcare affordable |

| Books and newspapers | Exempt to promote education |

| Agricultural produce | Exempt to support farming sector |

| Basic foodstuffs and agricultural supplies | Exempt from import sales tax |

| Exports | Zero-rated or exempt to encourage trade |

| Office stationery | Generally zero-rated/exempt, some items under review |

| Plant, machinery, equipment for Special Zones | Exempt to promote industrial development in zones |

| Goods for nonprofit/government hospitals and educational institutions | Exempt from sales tax and customs duties |

| Certain pesticides | Exempt if registered by the Department of Plant Protection |

| LNG for fertilizer manufacturers | Exempt as feedstock |

| Diplomatic goods | Exempt for diplomats and privileged persons |

| Raw materials for EPZs and the Gwadar Special Economic Zone | Zero-rated/exempt to boost exports and industrial activity |

These exemptions are detailed in the Sales Tax Act 1990, particularly in the Fifth and Sixth Schedules, and related government notifications

Conditions, Restrictions, and Procedures

The company selling the machinery must be properly registered under the law.

- A correct export bill must be provided, showing the seller’s registration number.

- The person or company buying the machinery must be a manufacturer working inside the Gwadar Free Zone and must have a certificate from the Gwadar Port Authority.

- The buyer must give a written agreement (called an indemnity bond) to the tax department. This promise says the machinery will not be sold, moved, or transferred out of the Gwadar Free Zone for five years, unless the tax office gives written permission.

- If the machinery is taken to any other part of Pakistan outside the Gwadar Free Zone, sales tax must be paid based on the import value.

- If any of these rules are broken, legal action will be taken. The buyer will also have to pay the sales tax, extra charges for late payment, and penalties.

Key Points from the Sales Tax Act, 1990

Here’s a summary of the sales tax exemptions under the Sales Tax Act, 1990, for Zone/Port businesses, especially those operating in the Gwadar Free Zone:

1. Zero-Rated Supplies – Section 4 read with Fifth Schedule

Certain supplies are zero-rated (0% sales tax):

Sr. No. 13

- Supplies of raw materials, components, and goods for manufacturing and export within the Gwadar Free Zone.

- If supplied to the tariff area of Pakistan, sales tax applies based on the import value.

Sr. No. 14

- Supplies of locally manufactured plant and machinery for manufacturers in the Gwadar Free Zone.

- Includes machinery, apparatus, control gear, and parts used in manufacturing.

- Conditions include:

- A supplier must be registered under the Act.

- Must file a bill of export.

- The purchaser must be a certified manufacturer in the Gwadar Free Zone.

- An indemnity bond must be submitted to prevent the movement/sale of machinery outside the Zone for five years.

- If moved to a tariff area, tax applies on the import value.

- Violation leads to recovery of tax, penalties, and legal action.

2. Exemptions – Section 13(1) read with Sixth Schedule

Some supplies/imports are exempt from sales tax, especially for specific companies linked to the Gwadar Port development.

Sr. No. 100A

- Materials, machinery, and equipment for Gwadar Port & Free Zone construction/operations.

- Applies to China Overseas Ports Holding Company Limited (COPHCL) and its subsidiaries, contractors & subcontractors.

- Ship bunker oils are also exempt.

- Conditions:

- Must hold a Concession Agreement.

- The Ministry of Ports & Shipping must certify the goods.

- No resale/disposal without FBR approval.

- Detailed documentation, invoicing, and reporting procedures must be followed.

Sr. No. 100B

- Supplies within Gwadar Free Zone by businesses established in the Zone are exempt for 23 years.

- Supplies outside the Zone are taxable.

Sr. No. 100C

- Vehicles imported by COPHCL and its subsidiaries for Gwadar projects are exempt for 23 years, subject to specific conditions.

Sr. No. 100D

- Machinery, equipment, and materials imported by investors for exclusive use in the Gwadar Free Zone or for exports are exempt.

- If taken out of the Zone for non-export purposes, sales tax must be paid.

Key Takeaways

- Zero-rating under Section 4 encourages exports and industrial setup within the Gwadar Free Zone.

- Exemptions under Section 13(1) benefit COPHCL and its affiliates involved in the Gwadar Port’s development.

- These incentives are backed by strict conditions, record-keeping, and government oversight.

Sales Tax Compliance in Pakistan

If your business is registered for sales tax in Pakistan, you need to issue a proper tax invoice for your sales. However, if you are selling directly to customers (like in retail), you are allowed to use a simplified invoice.

A standard tax invoice should include:

- Your business name and address

- Your sales tax registration number

- The customer’s name and address

- Date of the sale or supply

- A unique invoice number

- Details of the products or services sold

- The sales tax rate, the tax amount, and the total invoice value

- If you’re dealing in foreign currency, convert the amount into Pakistani Rupees (PKR) using an official exchange rate

When Does Sales Tax Apply? (Time of Supply)

Sales tax becomes payable depending on the type of supply:

- For services: Tax is due when the service is provided or when you receive payment, whichever comes first.

- For goods: Tax is due when you receive payment for the invoice.

- For imports: Tax must be paid when the goods are cleared through customs into Pakistan.

Managing Sales Tax Just Got Easier with Waystax.com

With frequent tax rate updates and complex compliance rules, staying on top of your sales tax can be overwhelming. Waystax.com takes the stress out of tax filing.

Whether you are a small business or a large enterprise, we help you stay compliant, accurate, and on time. Join thousands of businesses using Waystax.com for their peace of mind. Contact us now at Whatsapp 0346-3163692

Also, keep an eye on the latest news of

- Income tax rate in Pakistan

- Withholding tax rate in Pakistan

- Capital gains tax rate in Pakistan

- Corporate tax rate in Pakistan

References

- https://www.ey.com/en_gl/technical/tax-alerts/pakistan-increases-sales-tax-and-federal-excise-tax-rates

- https://www.vatupdate.com/2024/12/15/pakistan-holds-sales-tax-rate-steady-at-18-for-2025/

- https://tradingeconomics.com/pakistan/sales-tax-rate

- https://kkconsultant.net/sales-tax-rate/

- https://pra.punjab.gov.pk/FAQs/Index

- https://blog.taxationpk.com/srb-sales-tax-rates-in-sindh/

- https://www.brecorder.com/news/40249817/supplies-made-to-unregistered-persons-rate-of-further-sales-tax-increased-to-4pc

- https://www.dawn.com/news/1916435