Looking for a Company Registration Consultant?

We helped 150+ Companies in their registration process

Looking for Tax Filing Consultant for your Business?

1000+ IT Startups Trust our Tax Services

Simplify your Company Registration

Why Register Your Company with Waystax?

We are aware of the complexity and legal requirements that come along with company registration in Pakistan.

From the right business structure to all the paperwork with SECP (Securities and Exchange Commission of Pakistan), we take all the hassle out of the process.

So, you can focus on what matters most i.e. growing your business.

Unveiling the Reasons for Consultancy Approaches

Why Should You Partner With WaysTax

HOW DO WE WORK

Consultation

Request a free consultation with our experts, and we will talk about your business needs.

Documentation

To prepare the legal documentation we gather and file all the documents with SECP and other authorities.

Registration

After the approval of the paperwork, your company is officially registered.

Support

We offer after service support to keep your company compliant with local regulations.

TYPES OF COMPANY REGISTRATION IN PAKISTAN

Private Limited Company Registration (PVT LTD):

A PVT LTD in Pakistan is a separate legal entity with limited liability for its shareholders. It requires a minimum of two shareholders, and shares are privately held, making it suitable for small to medium-sized businesses.

Single Member Company Registration (SMC PVT LTD):

A single shareholder private limited corporation is known as an SMC. It is perfect for business owners who want to enjoy corporate perks but still maintain total control over their enterprise since it provides minimal liability.

Limited Liability Partnership Registration (LLP):

An LLP in Pakistan combines features of both a partnership and a company. It provides limited liability protection to partners and is best suited for professional services firms or small businesses wanting flexibility in management.

Sole Proprietor:

A sole proprietorship is a business owned and controlled by a single individual. It is simple to establish, and as there is no legal separation between the owner and the company, the owner is fully liable for all debts and liabilities.

Documents Required for Company Registration in Pakistan

After your company name is approved, you need to submit these documents to the SECP:

- Company Information

- Company Rules

- Copies of the CNICs of the directors of your company

- Payment Proof/bank deposit if you paid offline

- Authorization by the subscribers for the filing of documents

- Registration Fee

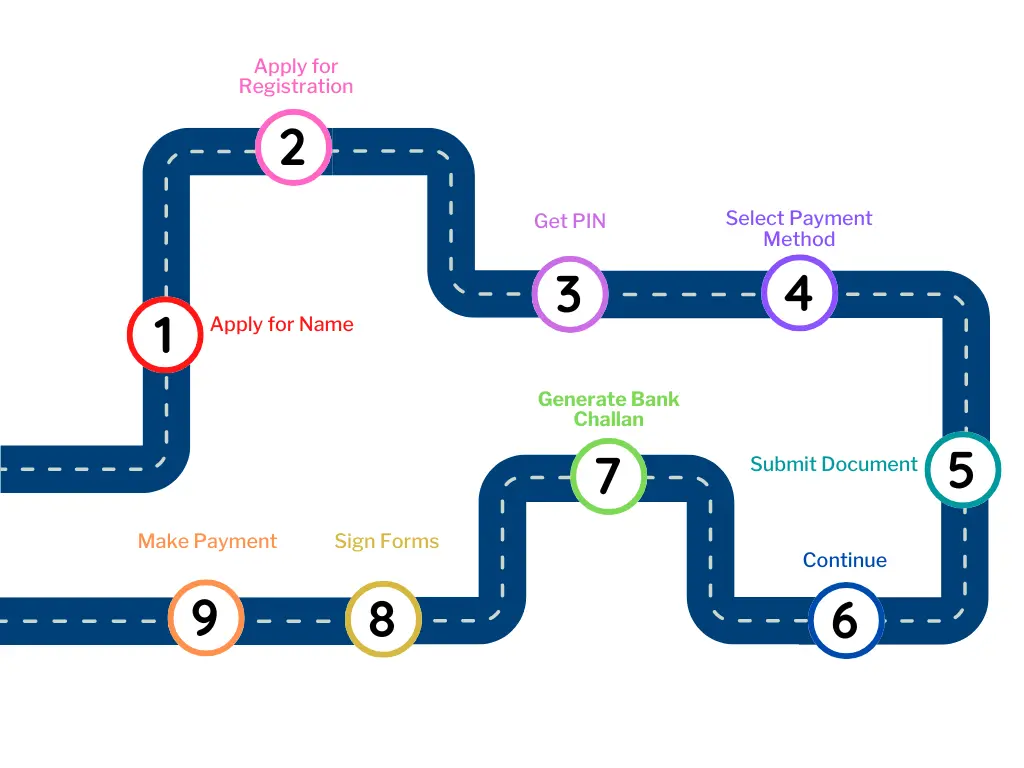

COMPANY REGISTRATION PROCESS IN 9 STEPS

RELATED SERVICES

Events & News

HOW TO REGISTER A COMPANY IN PAKISTAN

If you want to register a new company in Pakistan directly, you have two options for submitting your application:

- Physical submission: As per the Companies (Incorporation) Regulations, 2017

- Online submission: Through SECP’s e-services.

The first step for both methods is to get the proposed company name approved by the registrar.

METHOD 1. COMPANY REGISTRATION THROUGH PHYSICAL SUBMISSION

Here’s how you can apply physically to get a company name:

- Download and fill out Inc-Form-1.

- Submit Inc-Form-1 to one of the SECP’s Company Registration Offices, available in nine cities.

Once the registrar approves your name, they will issue a name availability letter and reserve the name for 60 days.After receiving the letter, you can register with the company. For more details, you can refer to the Companies (Incorporation) Regulations, 2017.

METHOD 2. COMPANY REGISTRATION THROUGH ONLINE PORTAL

If you prefer SECP company registration online, here are the steps for how to register a company in Pakistan online

USER REGISTRATION

Before you can apply for a company name or registration online, you need a Personal Identification Number (PIN). Follow these steps:

- Go to SECP e-Service.

- Choose to Sign up as a national or foreign user.

- Complete the form with your information.

You’ll receive a 4-digit PIN on your email and phone. This PIN will be used to electronically sign forms and documents.

Important Notes

- Your CNIC/passport number and the password you create will serve as your login for future use.

- If the company has more than one subscriber, each subscriber must create their own user ID and password.

LOGIN TO SECP’S E-SERVICES

- After getting your PIN, Visit SECP eService

- Log in using your CNIC and password.

- You will see the following options:

- Company Name Reservation

- Name Reservation and Incorporation (combined)

- LLP Name Reservation

- LLP Name Reservation and Incorporation

If you choose the combined process (name reservation and incorporation), you can do both at the same time.

However, this option is not available for foreign companies or companies requiring prior approvals.

ONLINE COMPANY REGISTRATION IN PAKISTAN | 9 STEPS

Here’s the step-by-step process:

- Application and Fee Payment:

- On the data entry page, provide three proposed company names and their significance, and select the type of company and principal business activity from the dropdown menu.

- Select the payment mode from the options:

- Bank challan

- Credit card

- 1LINK ePayment (EasyPaisa, mobile banking, ATM, internet banking)

- Company Information:

- Enter company details such as registered office address, telephone number, email address, and main line of business.

- Authorized & Paid-Up Capital:

- Authorized capital is the maximum share capital the company can raise. The minimum authorized capital is Rs. 100,000, which is the least amount for which the company registration fee will be charged.

- Paid-up capital is the amount of capital actually taken by the company’s members.

- Subscriber, Director, and Chief Executive Details:

- Add the details of subscribers, directors, and the chief executive. Use the “add” and “remove” buttons as needed to enter the required information.

- Applicant/Declarant Details:

- Enter your name, address, phone number, email, and CNIC or passport number.

- Continue:

- After entering all the details, click the Continue button. You’ll then see a list of documents to submit:

- Update Form Data: Allows you to edit any entered data.

- View Forms: View the generated forms (cannot be edited here).

- Information for Third Parties: Enter additional information to generate the company’s NTN.

- Attachments: Attach documents like your CNIC and name availability letter (for combined incorporation, this is automatically attached).

- Memorandum & Articles of Association: These will be generated based on the business activity you select.

- Generate Bank Challan:

- If paying by challan, click Generate Challan and save it. The system will create a challan based on your authorized capital and filing fee.

- Sign Forms:

- Each subscriber needs to log in, use their PIN, and sign the forms. Once all forms are signed, click Submit to SECP. You will receive a process reference number for future use.

- Make Payment:

- You can pay through:

- Challan at MCB or UBL branches

- Credit Card via the online portal

- 1LINK network (ATM, mobile, or internet banking)

- MCB Online Fund Transfer for MCB Account Holders

Requirements of Company Registration for Foreign Directors/Subscribers

After your company name is approved, you need to submit these documents to the SECP:

| Requirement | Details |

| Undertaking | Required in case of a security clearance issue. |

| Foreign Individual’s Documents | 5 copies of the individual’s CV, passport-sized photos, and personal details. |

| Foreign Company’s Documents | Company profile, list of directors, and certified copies of relevant documents. |

Certificate of Incorporation for Foreigners

After submitting the documents and paying the fee, the SECP processes your application within four hours. The certificate of incorporation will be emailed to you.

One-Window Facility for Foreigners

Your company’s data will be sent to the FBR for NTN registration. The FBR will send the NTN login details to the Chief Executive’s email and phone.

7 Points to Consider Before Registering a Company in Pakistan

To have a smooth process of registration, you must consider a few things before starting :

- Type of Company: Decide whether you want to register as a Single Member Company (SMC), Private Limited Company, or Public Limited Company. The choice depends on whether you want to work solo or with partners and whether you plan to invite public investors.

- Company Name: Pick a unique name that reflects your business. Make sure it’s not already used by another company or trademarked. It’s smart to check with the SECP and trademark registries.

- Capital Structure: Define your company’s capital structure. Authorized Capital is the total capital your company can raise. While Paid-up Capital is the actual amount invested by shareholders. Choose these amounts based on your business plan.

- Licenses & Approvals: Some businesses in Pakistan, like banking or security services, need licenses. Before registering, make sure to check if your business needs anything.

- Applicable LawsL: Understand the laws related to employment, labor, and business that apply to your industry. Hire a lawyer to guide you through legal matters.

- Tax Liabilities: Companies in Pakistan have to pay taxes, like income tax and sales tax. Consult a tax expert to understand your company’s tax obligations and set up proper accounting.

- Compliance: Every company has to follow some rules. For some, it’s just simple reports, while others have more things to follow. Make sure you know what rules your business needs to follow before starting.

How to Check Company Registration in Pakistan

In Pakistan, you can check if a company is registered through the Securities and Exchange Commission of Pakistan (SECP) online system. Here’s how:

1. Search Company Name on SECP Portal

- Go to the SECP eServices website: eservices.secp.gov.pk

- Use the “Name Search” option.

- Type the company name. You can search by:

- Exact name

- Names starting with certain words

- Names that include certain words

- The system will show if the name is already registered or still available.

2. Check Company Registration Details

Or send an SMS: type ATL [space] NTN and send to 9966 to check tax registration status.

You can also see the full list of registered companies on the SECP website.

For tax details, go to the FBR Iris portal and enter the company’s NTN (National Tax Number).