What to Do After NTN Verification in Pakistan: Complete Guide

Getting your NTN verification done is a big achievement for every taxpayer in Pakistan. Whether you’re a freelancer, salaried employee, or business owner, your NTN (National Tax Number) is your digital tax identity recognized by the Federal Board of Revenue (FBR).

But the process doesn’t stop after receiving your NTN certificate. What should you do next to make the most of it?

In this complete guide, we’ll explain step-by-step what to do after NTN verification — from activating your profile on the FBR IRIS portal to filing your tax returns, keeping records, and enjoying taxpayer benefits.

Need expert help with your taxes?

Waystax experts will simplify your tax management for you.

What Is NTN and Why It Matters

NTN stands for National Tax Number. It’s a unique 7-digit ID issued by the Federal Board of Revenue (FBR) to identify every taxpayer in Pakistan.Visit Waystax NTN Registration Services,Pakistan’s trusted online tax platform.

You’ll need your NTN certificate for:

- Filing income tax returns every year

- Opening a business bank account

- Registering a company or business

- Performing import/export activities

- Participating in government contracts or tenders

Without NTN verification, you won’t be listed as an active taxpayer, and FBR may apply higher tax rates or even penalties on your financial activities.

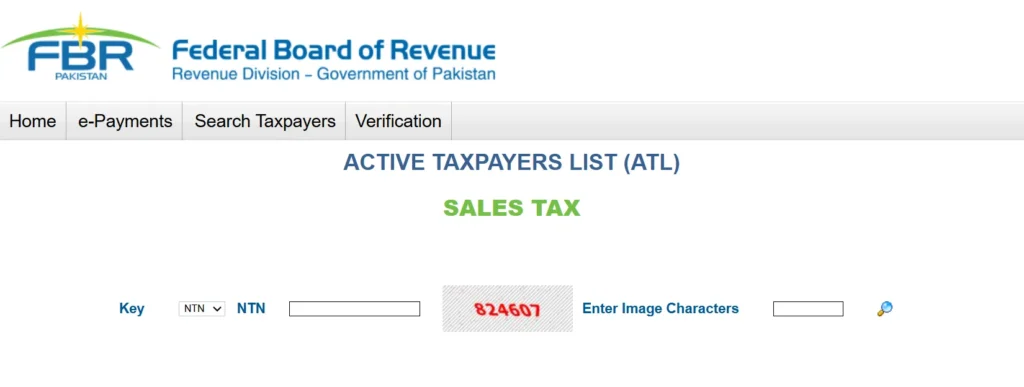

How to Check NTN Verification Online (FBR Method)

You can easily perform online NTN verification using your CNIC through the official FBR portal.

Steps to Check NTN Verification:

- Visit the official FBR NTN Verification Portal.

- Choose “NTN Inquiry” or “CNIC Inquiry.”

- Enter your NTN number or CNIC number.

- Click “Verify.”

- Your registered taxpayer details will appear instantly.

tip: You can also perform NTN number check with CNIC online if you forget your NTN. This FBR NTN verification confirms that your tax identity is valid and active in the system.

What to Do After NTN Verification

Now that you’ve successfully verified your NTN, follow these steps to stay compliant and enjoy all taxpayer benefits.

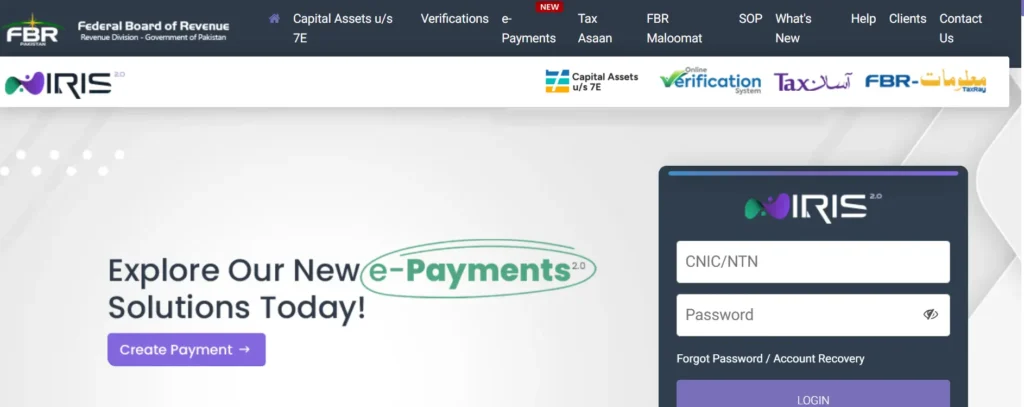

1. Activate Your IRIS FBR Profile

Go to the IRIS FBR Portal and log in using your CNIC and password.

Update your profile by adding:

- Income sources (salary, business, freelancing, etc.)

- Personal details and address

- Contact information

A complete profile ensures smooth filing and tax processing.

2. File Your Annual Income Tax Return

After your NTN verification, the next step is filing your income tax return.

This is how FBR evaluates your income, expenses, and tax payments. If you don’t file returns, your name will be removed from the Active Taxpayer List (ATL), resulting in:

- Higher tax rates on banking transactions

- Extra charges on property and vehicle purchases

- Loss of credibility as a registered taxpayer

3. Get Your Tax Deduction Certificate

Once your name appears in the Active Taxpayer List, you’ll receive a Tax Deduction Certificate showing that your NTN is active.

It helps you enjoy:

- Lower withholding taxes on bank transactions

- Reduced property taxes

- Tax benefits on investments and salaries

Keep this certificate for proof during audits or business dealings.

4. Keep and Organize Your Tax Records

Always maintain digital and physical copies of:

- NTN Certificate

- Tax Return Receipts

- Payment Challans

- Business and Income Records

FBR can request these anytime during NTN inquiry or tax audits.

5. Register for Sales Tax (If Needed)

If your business deals in goods or services and earns above the FBR sales tax threshold, you must register for Sales Tax using the same NTN.

This can be done through FBR’s e-Registration system by uploading:

- CNIC and utility bill

- Business ownership proof

- Bank statement or certificate

6. Keep Your Information Updated

If your income source or business address changes, log in to your IRIS account and update it immediately. Outdated information can cause tax notices or errors in the ATL.

Common Issues During NTN Verification

| Problem | Possible Cause | Quick Fix |

| Incorrect data on FBR | Typing errors or incomplete registration | Double-check CNIC and NTN entries |

| “Record Not Found” message | NTN not activated or linked | Recheck IRIS profile or contact FBR support |

| Wrong contact details | Outdated email or mobile number | Update via IRIS settings |

| Verification not showing | Delay in data sync | Wait 24 hours or contact FBR helpline |

If the problem continues, reach out to Waystax for fast, professional support.

Benefits of Completing NTN Verification

| Benefit | Explanation |

| Lower Tax Rates | Active taxpayers enjoy reduced taxes on banking and property. |

| Legal Protection | Proof of being a verified, compliant taxpayer. |

| Business Growth | Required for tenders, contracts, and foreign partnerships. |

| Financial Access | Mandatory for opening corporate accounts or getting loans. |

Completing NTN online verification helps you build credibility and avoid unnecessary penalties.

Final Thoughts

Completing your NTN verification is only the beginning of becoming a responsible taxpayer in Pakistan. To stay compliant:

- Keep your IRIS FBR profile updated

- File returns regularly

- Maintain all financial records

It not only keeps you in the Active Taxpayer List (ATL) but also helps you enjoy lower taxes, better financial credibility, and business growth.